Whole Life Insurance

Get whole life insurance to protect your future and the people you love. This lifelong coverage builds cash value over time and pays out a guaranteed benefit when it’s needed most. Whether it’s to help pay off debt, support your family, or leave a lasting legacy, whole life insurance offers peace of mind that lasts a lifetime.

Whole LIfe Insurance

Whole Life Insurance

Get whole life insurance to protect your future and the people you love. This lifelong coverage builds cash value over time and pays out a guaranteed benefit when it’s needed most. Whether it’s to help pay off debt, support your family, or leave a lasting legacy, whole life insurance offers peace of mind that lasts a lifetime.

Coverage amount of up to $750,000

Premiums starting at $25/month

No medical exams or blood tests required

Built-in guaranteed cash values after 5 years

Extreme Disability Benefit of up to $250,000 included at no additional cost

Age eligibility between 18 to 80 years old

Instant Issue

The coverage highlights are listed above. For comprehensive details on coverages, exclusions, and terms, please refer to the policy wordings.

Why get Life Insurance?

What is Whole Life insurance, and why do I need it?

If you want to leave a legacy and guarantee your loved ones financial well being, then you might want to consider whole life insurance. Whole life insurance is a type of life insurance that provides lifelong coverage and builds cash values over time. The policy pays a guaranteed, tax-free death benefit to your beneficiaries, which can be used to cover final expenses, pay off debts, or provide financial support for your family. Due to its permanent coverage and cash value growth, whole life insurance is an excellent way to secure your financial future and leave a lasting legacy for the people you love.

How much Whole life insurance coverage do I need?

The amount of coverage you need depends on various factors such as your current financial situation, outstanding debts, future expenses, and the number of dependents. A good rule of thumb is to aim for a coverage amount that is at least 10 times your annual income. In some cases, purchasing both Whole Life and Term Life policies can be a smart way to ensure financial security while keeping monthly premiums more affordable.

What types of life insurance are available, and which is right for me?

There are two main types of life insurance: term life and whole life. Term life provides temporary coverage for a specific term (e.g., 10, 20, or 30 years) and is more affordable, but it offers the same amount of protection during that term. Whole life, on the other hand, is a more expensive option, but it provides guaranteed, lifelong coverage and builds cash value over time. Deciding which is right for you depends on your individual needs and budget. Neither term life insurance nor whole life coverage on the Goose app requires a blood test, agent assistance, or any other complex process.

Can I change my Whole life insurance coverage over time?

With Goose Insurance, if you purchase a life insurance policy, you have 10 days to cancel or make any necessary changes. Once the policy is in effect, you can only reduce the coverage amount. If you wish to increase your coverage, you can apply for an additional Whole Life policy, provided you meet the eligibility criteria at the time of application. You can contact one of our licensed agents, who are direct employees of Goose Insurance, to discuss your needs. Email us at support@gooseinsurance.com or chat with us directly through the Goose Insurance app.

How are life insurance premiums determined?

Generally, life insurance premiums are influenced by factors such as your age, health, lifestyle, coverage amount, and type of policy. The younger and healthier you are when you purchase a policy, the lower your premiums will be. It's advisable to lock in a policy early to secure more favourable rates. With the Goose Insurance app, you can purchase term and whole life policies instantly.

What is a beneficiary, and how do I choose one?

A beneficiary is the person or entity who receives the death benefit if you pass away. You can choose one or multiple beneficiaries, and they can be family members, friends, or even charitable organizations. It's crucial to regularly review and update your beneficiaries to reflect any changes in your life circumstances. In some provinces, your beneficiaries may be deemed irrevocable; it is always a good idea to inquire about provincial laws pertaining to beneficiaries.

Is there a waiting period before my Whole life insurance coverage takes effect?

In most cases, life insurance coverage takes effect immediately upon approval and payment of the first premium. It is also very common to have a waiting period for certain causes of death such as suicide or pre-existing medical conditions. It's essential to carefully review the terms of your policy, as certain situations or policy types may have specific exclusions. You can contact one of our licensed agents, who are direct employees of Goose Insurance to discuss.

Where do I see coverage details and exclusions?

Please refer to the policy wordings for the full list of benefits, exclusions, and limitations. You can also contact our licensed agents at support@gooseinsurance.com if you have any additional questions.

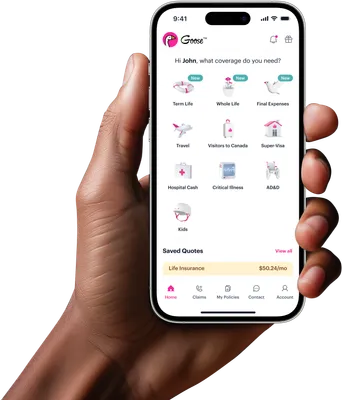

Get Goose

✔️ Download the App

✔️ Sign Up and Explore

✔️ Get a Quote and Get Covered

What Policyholders Say

4.8

749 Ratings

4.8

AppStore

1.4k Ratings

4.4

66 Ratings

It was so affordable and easy to get life insurance. Although the coverage amount is not big, it’s really just the cost of a few cups of coffee.

Wenzhen

Email review

Quick, easy, cheap, convenient. Couldn’t ask for more.

Pauline

App Store Review

During this trying time, the level of service is simply amazing. I have never seen any insurer that takes ownership and sees things through like Goose!

Peter

Facebook review

Goose had the best price and the best policy I could find for travel insurance. I'm only using Goose from now on!

Bryan

Google review

Lots of companies claim an easy sign-up, instant life insurance and the lowest prices. But so far none offer as low a price as Goose.

Dorothy

Email review

In my multiple decades on this planet, I cannot ever think when I bought insurance and said 'that was painless, quick, and kinda a fun experience.'

Brent

App Store review

Easy to use, completely inexpensive and peace of mind! Love it. I’ll never 'fly' with anyone else ever again!

Patti

Facebook review

Impressive and simple app design. Easy to follow, and got my travel insurance in 2 mins! Thank you.

Aarjav

App Store review

The App was amazing, and thought the premium was more than fair. No printed documents, etc.

Agata

Google review

I was happy to find Goose for my critical illness insurance. Everything they were offering (price, coverage, and terms) seemed perfect for me.

Jason

Email review

The quote process was fast and very user friendly. The price is on par or better than a couple other companies I got quotes from.

Lorien

App Store review

I went with Goose after watching their ad on TV, since the rate for the same coverage elsewhere is at least $50.00 higher.

Gordon

Email review