Critical Illness

Prepare for the unexpected with critical illness coverage. Safeguard your finances and focus on recovery by receiving a lump sum payment upon diagnosis of a covered critical illness like cancer, heart attack, stroke, and other life-threatening conditions.

Critical Illness

Critical Illness

Prepare for the unexpected with critical illness coverage. Safeguard your finances and focus on recovery by receiving a lump sum payment upon diagnosis of a covered critical illness like cancer, heart attack, stroke, and other life-threatening conditions.

25 conditions covered

Up to $50,000 of coverage

No medical exam for certain coverage amounts

Premiums as low as $10 a month

Instant approval

Coverage highlights are shown above, for full details on coverages and exclusions, kindly view the policy wordings.

Why get Critical Illness Coverage?

What is critical illness coverage?

Critical illness coverage provides financial support upon the diagnosis of a covered critical illness. It offers a lump sum payment, allowing you to focus on recovery without the added stress of financial burdens.

What critical illnesses are covered?

Our critical illness coverage includes a range of illnesses, such as cancer, heart attack, stroke, and more. The specific illnesses covered may vary, so it's essential to review the policy wordings for a comprehensive list of the 25 conditions covered.

Can I customize my critical illness coverage?

Yes, we offer flexible coverage plans, allowing you to tailor your critical illness coverage to meet your specific needs. Whether you're looking for comprehensive protection or specific illness coverage, we have options for you.

How do I get critical illness coverage?

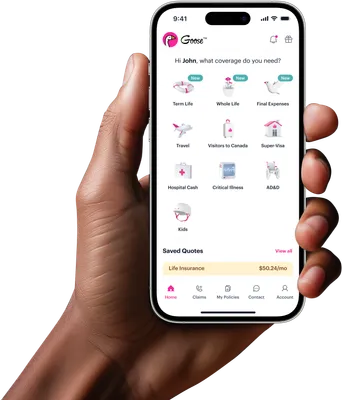

To get critical illness coverage, either scan the QR code above or click your app store button at the bottom of the page. Once you have the app, making an account is very easy and then we'll simply run you through a short questionnaire.

Where do I see coverage details and exclusions?

Please refer to the policy wordings for the full list of benefits, exclusions, and limitations. You can also contact our licensed agents at support@gooseinsurance.com if you have any additional questions.

What is excluded?

Pre-existing conditions are excluded for the first 24 months of coverage.

Get Goose

✔️ Download the App

✔️ Sign Up and Explore

✔️ Get a Quote and Get Covered

What Policyholders Say

4.8

749 Ratings

4.8

AppStore

1.4k Ratings

4.4

66 Ratings

It was so affordable and easy to get life insurance. Although the coverage amount is not big, it’s really just the cost of a few cups of coffee.

Wenzhen

Email review

Quick, easy, cheap, convenient. Couldn’t ask for more.

Pauline

App Store Review

During this trying time, the level of service is simply amazing. I have never seen any insurer that takes ownership and sees things through like Goose!

Peter

Facebook review

Goose had the best price and the best policy I could find for travel insurance. I'm only using Goose from now on!

Bryan

Google review

Lots of companies claim an easy sign-up, instant life insurance and the lowest prices. But so far none offer as low a price as Goose.

Dorothy

Email review

In my multiple decades on this planet, I cannot ever think when I bought insurance and said 'that was painless, quick, and kinda a fun experience.'

Brent

App Store review

Easy to use, completely inexpensive and peace of mind! Love it. I’ll never 'fly' with anyone else ever again!

Patti

Facebook review

Impressive and simple app design. Easy to follow, and got my travel insurance in 2 mins! Thank you.

Aarjav

App Store review

The App was amazing, and thought the premium was more than fair. No printed documents, etc.

Agata

Google review

I was happy to find Goose for my critical illness insurance. Everything they were offering (price, coverage, and terms) seemed perfect for me.

Jason

Email review

The quote process was fast and very user friendly. The price is on par or better than a couple other companies I got quotes from.

Lorien

App Store review

I went with Goose after watching their ad on TV, since the rate for the same coverage elsewhere is at least $50.00 higher.

Gordon

Email review